What is Bank Reconciliation?: Types, Importance, and Best Practices

Bank reconciliation is a vital financial process that ensures the accuracy of a company’s financial records by comparing transactions and balances between its accounting books and bank statements. This verification helps detect discrepancies such as errors or unauthorized transactions, ensuring the integrity of financial statements and preventing fraud. In this article, we explore the definition, types, importance, and steps involved in bank reconciliation, as well as common challenges encountered.

What is Bank Reconciliation?

Bank reconciliation is the meticulous process of matching the cash balances recorded in a company’s ledger with those in its bank statement. This process identifies discrepancies like timing differences or errors in transaction recording, ultimately producing a bank reconciliation statement that aligns both sets of records.

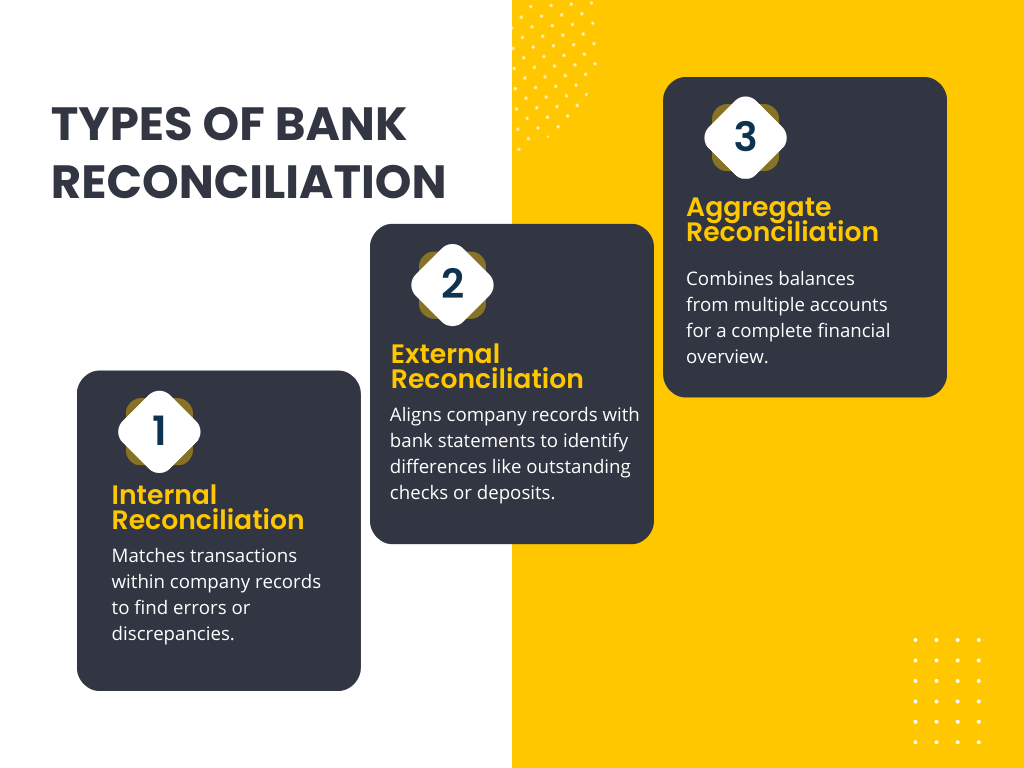

Types of Bank Reconciliation

Bank reconciliation can be categorized into three primary types, each serving distinct financial management purposes:

- Internal Reconciliation: This involves matching transactions within the company’s accounting records, such as reconciling the cash account in the ledger against receipts or payment records. It ensures accurate transaction recording and detects internal errors or discrepancies.

- External Reconciliation: This focuses on aligning the company’s records with external statements, typically bank statements. It compares the bank’s balances with the company’s ledger to identify differences due to outstanding checks, deposits in transit, bank errors, or unauthorized transactions, maintaining cash flow accuracy.

- Aggregate Reconciliation: Used by companies with multiple accounts, this consolidates individual account balances for a comprehensive financial overview. It combines account reconciliations into a single report, providing insights into total cash resources, pending transactions, and potential liquidity issues.

How to Do a Bank Reconciliation

- Compare transactions between accounting records and bank statements to find discrepancies.

- Adjust for outstanding checks by subtracting them and adding deposits in transit to reconcile balances.

- Account for bank errors and fees by adjusting the balances accordingly.

- Verify final balances to ensure books and bank statements match, resolving any discrepancies for accurate financial records.

Importance of Bank Reconciliation

- Detects errors in bank or accounting processes, like double entries or transposition errors.

- Acts as a check against unauthorized transactions, aiding in fraud prevention.

- Facilitates informed cash flow management decisions by providing accurate fund availability.

- Ensures compliance with accounting standards and regulatory requirements.

- Maintains financial statement accuracy, fostering trust among stakeholders in the business’s financial health.

Challenges With Bank Reconciliations

Common challenges associated with bank reconciliations include:

- Timing discrepancies due to delays in transaction processing by the bank.

- Errors from the bank such as incorrect postings or missing transactions.

- Undetected fraudulent activities like unauthorized withdrawals or deposits.

- Increased complexity for large-scale operations with multiple accounts and transactions.

Bank Reconciliation Example

ABC Enterprises, a small retail company, is conducting bank reconciliation for June. ABC processes customer payments, pays suppliers, and incurs various operating expenses. During the month-end reconciliation process, ABC identifies discrepancies between its internal records and the bank statement:

- Two checks totaling $1,500 issued to suppliers have not yet cleared the bank.

- A customer payment of $2,000 made via electronic transfer on June 30th is not reflected in the bank statement.

- The bank has charged a monthly service fee of $30, which ABC Enterprises was not previously aware of.

To reconcile its accounts, ABC takes the following steps:

- ABC updates its internal records to reflect the outstanding checks and deposits in transit, ensuring alignment with the bank statement.

- ABC contacts the bank to inquire about the unprocessed deposits and clarify any unexpected fees. They request documentation to support the charges and negotiate where applicable.

- ABC implements controls to prevent future discrepancies, such as regularly monitoring outstanding checks and deposits, reviewing bank statements promptly, and negotiating favourable banking terms to minimize fees.

How to use technology for bank reconciliation

Here are the steps to use technology for bank reconciliation in single-line bullet points:

- Utilize automated bank reconciliation software.

- Integrate systems for monthly reconciliation.

- Automate matching with advanced rules.

- Implement unified financial platforms.

- Automatically generate ledger entries for unmatched items.

- Resolve anomalies through manual reconciliation.

- Monitor in real-time with comprehensive reports.

- Consolidate transactions from multiple ledgers.

- Streamline matching with various criteria.

- Employ robotic process automation (RPA).

- Use finance dashboards for tracking and management.

How to integrate bank reconciliation with ERP systems

Here are the steps to integrate bank reconciliation with ERP systems in single-line bullet points:

- Connect bank accounts to ERP using automated bank connectivity.

- Ensure data from bank feeds is formatted according to ERP requirements.

- Implement automated reconciliation tools within the ERP system.

- Use advanced logic to handle complex reconciliation scenarios.

- Automate invoicing and collections and use digital ledgers for real-time tracking.

- Ensure system availability with 24-hour technical support.

How to choose the right bank reconciliation tool

Here are the key factors to consider when choosing the right bank reconciliation tool

- Seamless integration with ERP systems.

- High levels of automation for data import, transaction matching, and error identification.

- Handling high transaction volumes and multiple bank accounts.

- Real-time insights for better decision-making and cash flow management.

- Customization options for transaction categories and matching rules.

- Robust reporting capabilities and detailed audit trails.

- Ease of use with minimal training required.

Conclusion

In conclusion, bank reconciliation is a critical financial process that ensures the accuracy and consistency of financial records between a company’s internal accounts and its bank statements. By understanding the importance of bank reconciliation and implementing effective reconciliation procedures, companies can navigate financial challenges, mitigate risks, and position themselves for long-term success. Utilizing advanced bank reconciliation services and accounting services can further enhance the efficiency and reliability of this essential process.