Creating a Smarter SMSF Investment Strategy for Your Retirement

Self-managed super funds (SMSFs) offer individuals the autonomy to manage their retirement savings according to their specific financial goals and risk tolerance. A well-crafted investment strategy is crucial for SMSFs to achieve their objectives and ensure a secure financial future. This article will provide an in-depth overview of the key considerations and best practices for creating a smarter SMSF investment strategy, focusing on SMSF property investment strategies and the various investment options available.

Understanding Self-managed super fund (SMSF) investment Strategies

An SMSF investment strategy is a detailed plan outlining the types of investments an SMSF can make, hold, and realize to achieve its objectives. The strategy must be developed by the SMSF trustees and reflect the current and future financial needs of each fund member. The primary goal of an SMSF investment strategy is to maximize member returns while considering risk and liquidity needs.

Key Considerations for SMSF Investment Strategies

- Investment Objectives: The investment objectives of an SMSF must be clearly defined, considering the financial goals and risk tolerance of each member. These objectives should be aligned with the SMSF’s overall financial plan and the expected cash flow requirements.

- Diversification: SMSFs are required to diversify their investments to minimize risk and ensure that the fund is adequately protected against market fluctuations. This can be achieved by investing in a range of asset classes, such as cash, shares, and property, both locally and overseas.

- Liquidity: The SMSF’s liquidity must be considered, ensuring that the fund has sufficient cash reserves to meet its financial obligations, including paying member benefits and other expenses.

- Risk Profile: The risk profile of each member must be considered when developing the investment strategy. This includes considering the age, income needs, and retirement goals of each member.

- Review and Rebalancing: The investment strategy must be reviewed annually or whenever significant changes occur that affect the SMSF. Rebalancing the portfolio is essential to ensure that the fund remains aligned with its objectives and risk tolerance.

- Regulatory Compliance: SMSFs must comply with the Australian Taxation Office (ATO) and the Australian Securities and Investments Commission (ASIC) regulatory requirements. This includes maintaining accurate records and adhering to reporting requirements.

- Insurance and Risk Management: SMSFs should consider insurance and risk management strategies to protect their investments and ensure that the fund remains financially secure.

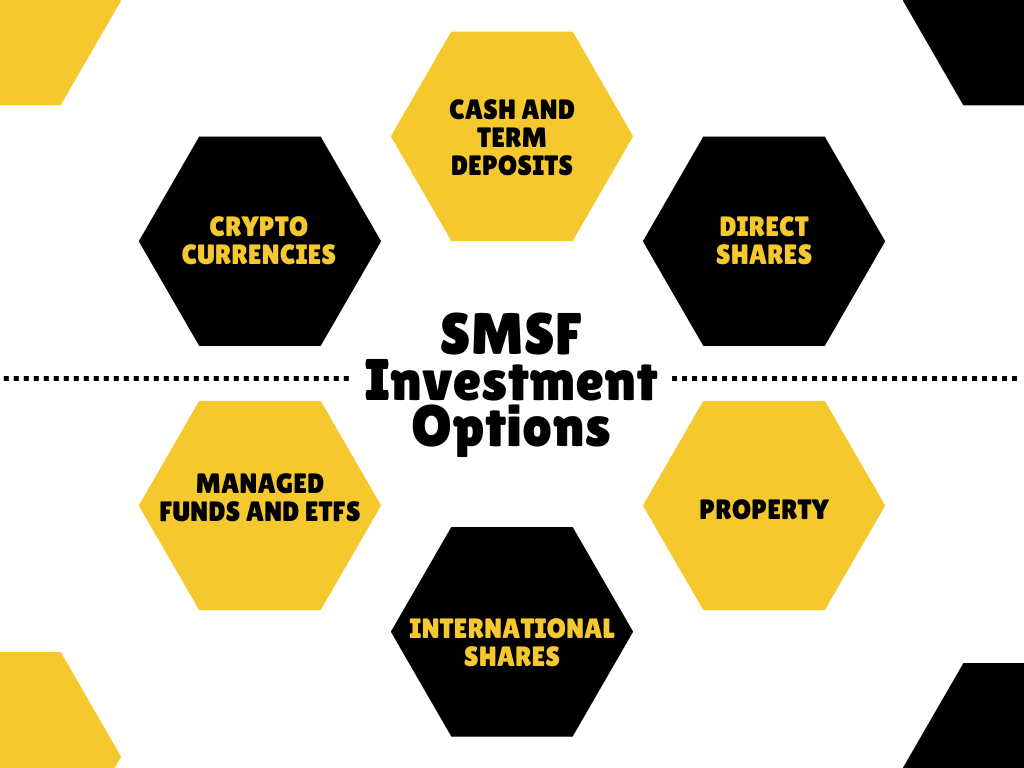

SMSF Investment Options

SMSFs have a wide range of investment options available, including:

- Cash and Term Deposits: SMSFs can invest in cash and term deposits, providing a low-risk and liquid option for short-term investments.

- Direct Shares: SMSFs can directly invest in shares, offering a broader range of investment opportunities and the potential for higher returns.

- Property: SMSFs can invest in property, including commercial and residential properties, as well as business premises. However, there are specific rules and restrictions to consider, such as not using SMSF funds to pay off personal debts or buy holiday homes.

- International Shares: SMSFs can invest in international shares, providing access to a broader global market and potentially higher returns.

- Managed Funds and ETFs: Managed funds and exchange-traded funds (ETFs) are competing with property investments in SMSF allocations. These investments offer diversification and the potential for long-term growth, making them attractive options for SMSF trustees.

- Cryptocurrencies: SMSFs can also invest in cryptocurrencies, although this is a higher-risk option and requires careful consideration of the associated risks and regulatory requirements.

These investment options provide SMSF trustees with the flexibility to create a tailored investment strategy that aligns with their individual goals and risk tolerance. However, it is essential to note that SMSFs require significant time and financial knowledge to manage effectively, and trustees must comply with strict regulations and laws.

Best Practices for SMSF Investment Approach

- Seek Professional Advice: It is recommended that SMSF trustees seek professional advice from a financial planner or investment advisor specializing in SMSF services to ensure that their investment strategy is tailored to their specific financial goals and risk tolerance.

- Monitor and Rebalance: Regular monitoring and rebalancing of the portfolio are essential to ensure that the SMSF remains aligned with its objectives and risk tolerance.

- Diversification: Diversification is critical for SMSFs to minimize risk and ensure that the fund is adequately protected against market fluctuations.

- Review and Update: The investment strategy must be reviewed annually or whenever significant changes occur that affect the SMSF. The strategy should be updated to reflect changes in the financial goals and risk tolerance of the members.

SMSF Property Investment Strategy

SMSFs can invest in property, both locally and overseas, using a variety of methods, including outright purchases and limited recourse borrowing arrangements. Property investments can provide a stable source of income and long-term capital growth, making them a popular choice for SMSFs.

What are the risks associated with SMSF property investments?

There are several key risks associated with investing in property through an SMSF:

- Higher costs: SMSF property loans tend to be more costly than other property loans.

- Cash flow: The SMSF must always have sufficient liquidity or cash flow to meet expenses such as loan repayments, insurance premiums, rates, and property management fees. It must also allow for retirement pension payments or lump sum withdrawals.

- Loan balance: There needs to be a strategy in place to repay the loan in the event of illness, disability, death of members, or rental vacancy.

- Difficulty unwinding: If the SMSF property loan documents and contract aren’t set up correctly, it can be very difficult to unwind the arrangement. The property may have to be sold, potentially causing substantial losses to the SMSF.

- Concentration risk: Investing solely in property leaves the SMSF open to concentration risk and liquidity risk. Diversifying into other asset classes can reduce these risks and make for less volatile returns.

- Liquidity risk: It takes substantially longer to sell a house than to make a withdrawal from a bank account. This poses significant liquidity risk, especially if the properties are geared or the SMSF is in the pension phase.

- Possible tax losses: Tax losses from the property can’t be offset against taxable income outside the fund.

- No alterations: The SMSF can’t make alterations that change the character of the property until the loan is paid off.

- Tax Implications: SMSFs must consider the tax implications of their investments, including capital gains tax and income tax. It is essential to minimize tax liabilities while maximizing returns.

Latest trends in SMSF investment strategies

According to the latest trends, SMSFs are increasingly focusing on sustainable property investments, commercial property, and adapting to changes in borrowing landscapes. Some key emerging trends in SMSF investment strategies include:

- Sustainable Property Investments: SMSFs are showing a growing interest in investing in properties with strong sustainability features, such as energy-efficient designs, renewable energy systems, and green certifications. This trend is driven by the potential for long-term cost savings and alignment with environmental, social, and governance (ESG) principles.

- Commercial Property Investments: Commercial property investments, including office spaces, retail outlets, and industrial facilities, are gaining popularity among SMSFs. These investments can provide stable rental income and potential for capital growth, while also allowing SMSF members to use the property for their business purposes.

- Adapting to Changes in Borrowing Landscapes: With ongoing regulatory changes and market conditions affecting SMSF borrowing arrangements, trustees are adapting their investment strategies to navigate the evolving landscape. This may involve exploring alternative financing options, such as joint ventures or syndicated investments, to access property opportunities.

- Increased Focus on Diversification: SMSFs are placing greater emphasis on diversifying their investments across different asset classes, sectors, and geographical regions to manage risk and enhance returns. This includes exploring opportunities in international markets, alternative assets, and emerging sectors like cryptocurrency.

- Emphasis on Long-Term Growth: SMSF trustees are increasingly taking a long-term view when developing their investment strategies, focusing on sustainable growth and income generation for their retirement. This involves carefully considering factors such as risk tolerance, liquidity needs, and tax implications.

By staying informed about these emerging trends and adapting their investment strategies accordingly, SMSF trustees can position their funds to capitalize on new opportunities while managing risks in the evolving financial landscape.

Conclusion

Creating a smarter SMSF investment strategy requires careful consideration of the financial goals and risk tolerance of each member. By understanding the key considerations and best practices for SMSF investment strategies, SMSF trustees can ensure that their fund is well-positioned to achieve its objectives and provide a secure financial future for its members.

FAQs

Q.1: What is a Self-Managed Super Fund (SMSF)?

A: An SMSF is a type of superannuation fund designed to provide retirement benefits to its members. Unlike other super funds, the members are usually also the trustees, giving them control over the investment decisions.

Q.2: How do I create a smarter investment strategy for my SMSF?

A: To create a smarter SMSF investment strategy, consider diversifying your portfolio, understanding your risk tolerance, regularly reviewing your investments, staying informed about market trends, and seeking professional financial advice.

Q.3: What types of investments can my SMSF include?

A: Your SMSF can include a variety of investments such as shares, property, fixed-income products, and managed funds. It’s essential to ensure these investments comply with the superannuation laws and are in the best interest of the members.

Q.4: Can I get professional help in managing my SMSF?

A: Yes, many SMSF trustees seek professional assistance from financial advisors, accountants, and legal experts to ensure compliance with regulations and to develop effective investment strategies.

Q.5: How do I ensure my SMSF remains compliant?

A: To ensure compliance, stay updated on superannuation laws, maintain accurate records, complete annual audits, and regularly consult with financial and legal professionals. Using professional administration services can also help manage compliance.