Tag: SMSF Updates

What Should Be The Self-Managed Superannuation Fund (SMSF) Investment Strategies?

The investment strategy for the SMSF is the key to make, control, and manage assets that are being consistent with the investment objectives of the SM...

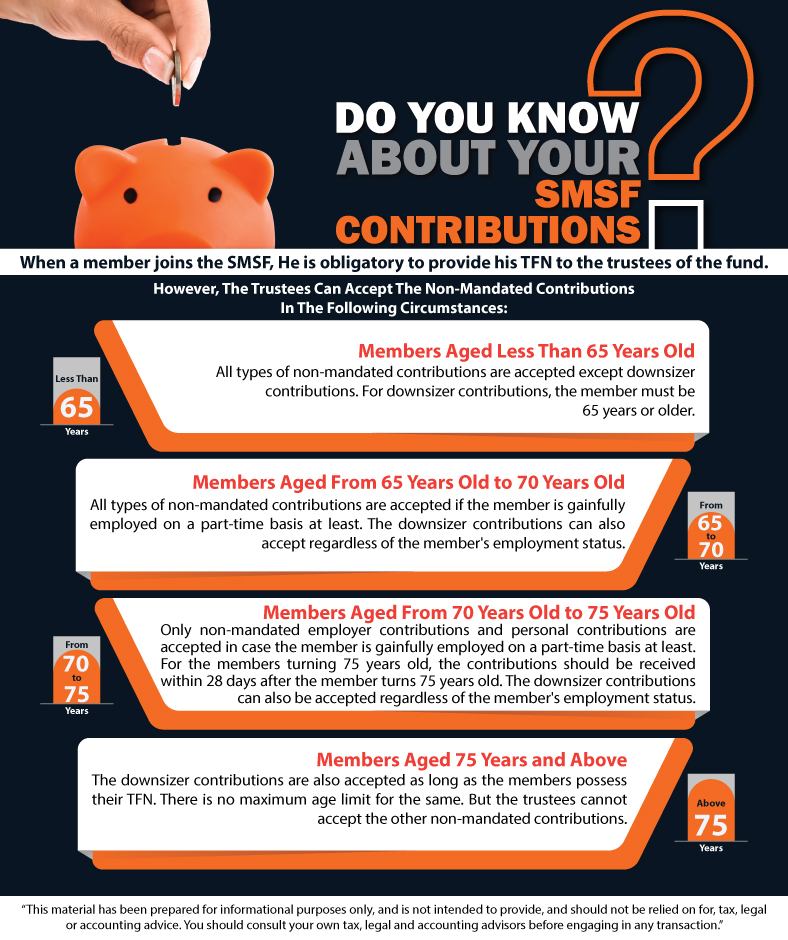

Do You Know About Your SMSF Contributions?

When the taxpayer is an SMSF trustee, he/she could accept contributions for the members which is acquired from various sources. However, not everythin...

Getting an Update About Limited Recourse Borrowing Arrangement

Limited Recourse Borrowing Arrangement (LRBA): An provision for the SMSF Trustee borrowing a loan from a third-party lender. This arrangement is usefu...

Have You Heard About Transfer Balance Account Report Reporting?

For SMSFs, one new event-based reporting (EBR) framework has commenced since July 1, 2018. This reporting helps the ATO to administer the Transfer Bal...

ATO Stricter in Late Lodgements

The late lodgements of SMSF have been a key focus in compliance for quite some time. While ATO addressed this concern, they have ramped up their appro...

Explore About Downsizer Contribution

The term Downsizer Contributions refers to the superannuation contributions which is sourced from the sale proceedings of current or former principal ...

Recent Revelations for SMSF Annual Return in 2019

Self-Managed Superannuation Funds is a good way to save money for the post-retirement stage. It is a trust fund wherein assets are conquered and utili...