Do You Know About Your SMSF Contributions?

When the taxpayer is an SMSF trustee, he/she could accept contributions for the members which is acquired from various sources. However, not everything good that happens is the icing on the cake. So this contribution. The contribution comes with some restrictions which mostly depend on the member’s age and contribution caps for them.

The trustees need to read and understand the contributions and rollovers which is inclusive of the amount, type and breakdown of components. Also, the trustees need to allocate the amount to the members’ accounts. The allocation should be done within 28 days of the end of the month in which the amount is being received.

There are some of the minimum standards that need to be fulfilled for accepting the contributions into the Self-Managed Super Fund (SMSF). Also, the trust deed of the SMSF’s fund may have more rules but whether a contribution is allowable depends on the following factors:

- Having the member’s tax file number (TFN): If not, the SMSF Trustee cannot accept member contributions.

- Contribution types: For example, the SMSF Trustees could accept mandated employer contributions viz. super guarantee contributions from the member’s employer at any point in time.

- Member’s age: For example, the SMSF Trustee cannot accept non-mandated contributions for the members who are aged more than 75 years old.

Generally, the SMSF Trustee won’t be able to accept any asset as a member’s contribution, but with some exceptions. If the SMSF receives an employer’s contributions except related-party employers, the trustees need an electronic service address for receipt of associated SuperStream data.

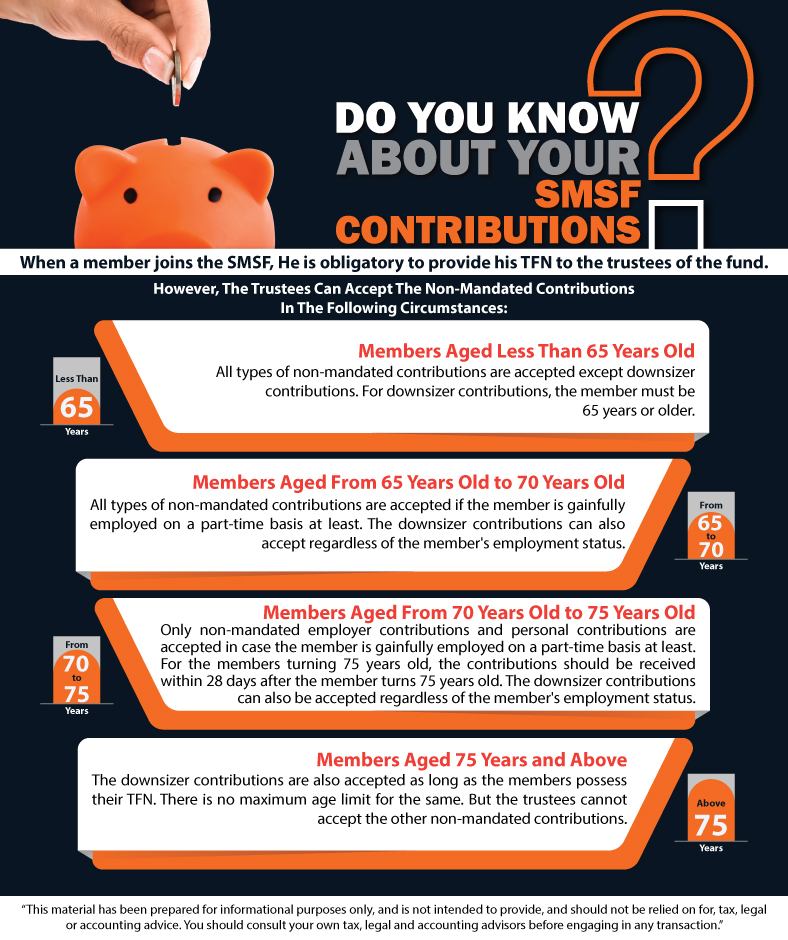

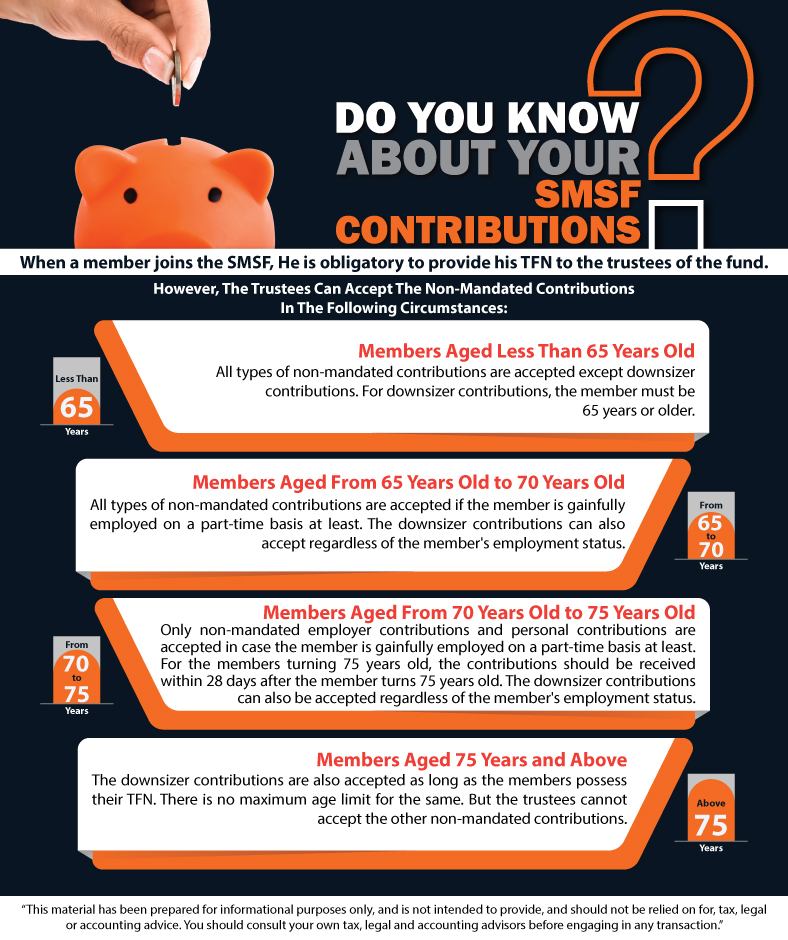

Member’s tax file number

When a member joins the SMSF, he is obligatory to provide his TFN to the trustees of the fund. The members could do this while registering the fund or joining of a new member.

However, if they don’t, the:

- The SMSF cannot accept any contributions for them viz. personal and eligible spouse contributions.

- SMSF has to pay extra taxes for the contributions made to the member’s account.

- The member would not be eligible to receive the super co-contributions.

What is the Mandated Employer Contributions?

The mandated employer contributions are the contributions that are made by an employer under an industrial law or an industrial agreement for the fund member’s benefits including super guarantee contributions. However, the SMSF Trustee can accept the mandated employer contributions for members at any instance, regardless of their age or the number of hours they would be working.

What are the Non-mandated contributions?

The Non-mandated contributions include:

- The contribution makes by employers above their super guarantee or award obligations viz. such as salary sacrifice contributions.

- Member contributions. The contributions made by/on behalf of the member viz.

- Personal contributions.

- Eligible proceeds from primary residence disposal (downsizer contribution).

- Super co-contributions.

- Eligible spouse contributions.

- Contributions made by a third party viz. insurer.

The non-mandated member contribution only accepted if the member possesses a valid tax file number (TFN). If the trustee receives the member contribution and does not have the member’s TFN, the trustees need to return the contribution within 30 days. “Stipulated Period” doesn’t go with the context Instead keep it “The Contribution must be returned within 30 days, unless the ,member gives you’re their TFN within that time.”

Concluding this, all the super co-contributions and employer contributions that are related to the valid contribution period for the members can be accepted anytime.